ValonOS: AI-Native Servicing Platform

One unified system. Infinite operational leverage.

What We're Building

ValonOS is an AI-native, unified system of record for mortgage servicing. It replaces the fragmented legacy stack that most servicers rely on today.

We spent half a decade operating a competitive mortgage servicer to learn every regulation, workflow, and edge case firsthand. ValonOS is the result: a platform built from real operational experience, not theoretical design.

We now sell this system to other servicers so they can run better operations with less cost, higher compliance, and continuous improvement through AI.

Why It Matters

Most servicers run on 20+ disconnected systems. Regulations change constantly. Manual processes create errors and compliance risk.

Without a single integrated foundation, servicers patch over problems instead of solving them. ValonOS gives them that foundation.

How ValonOS Works

ValonOS is a unified platform built from first principles. It brings accounting, workflows, task orchestration, and auditability into one coherent system. What once required more than 30 disconnected tools can now run inside a single platform.

We have built the foundation and proven its stability through real-world operations. Many of the system's core components are now in development or on the roadmap, which means the architecture is still taking shape. For engineers, that makes this one of the most exciting stages to join. You will help define the core abstractions, design how systems talk to each other, and bring the platform to life.

Core Components

Each component is critical to the leverage generated by the platform. Together, they treat accounting, workflows, tasks, and permissions as first-class concepts, fully enabling the needs of modern operations.

Unified Financial Service (UFS)

Multi-ledger, double-entry accounting and treasury layer. Every journal entry links to actual bank activity for per-transaction reconciliation.

- Models multiple parties (system, clients, loans)

- Cross-ledger links with dual-temporal tracking

- Handles reallocations, advance/recoupment, and fund settlement

- Per-transaction reconciliation with bank activity

ValonOS is designed as a compound product. Each layer builds on the one below it, creating increasing leverage and automation as more runs on the platform. For the builders joining us now, this is a rare opportunity to help architect the foundation that future industries will run on.

Deterministic System Automation

Human Agents

Reviews AI agent work and makes servicing decisions

LLM AI Agents

Trained on specific servicing processes to add capacity

Customizable Workflows

Connecting triggers + servicing actions into operational processes

APIs & Valon Data Schema

Restful API & VDS powering Valon applications and client custom applications

Servicing Actions

System defined discrete / atomic units of servicing "work", e.g. run an escrow analysis

Servicing Infrastructure & Unified Financial Service

multi-party double entry accounting + money movements + auto-reconciliation

Each layer builds on the foundation below, creating compound leverage

Interfaces: Where ValonOS Meets the User

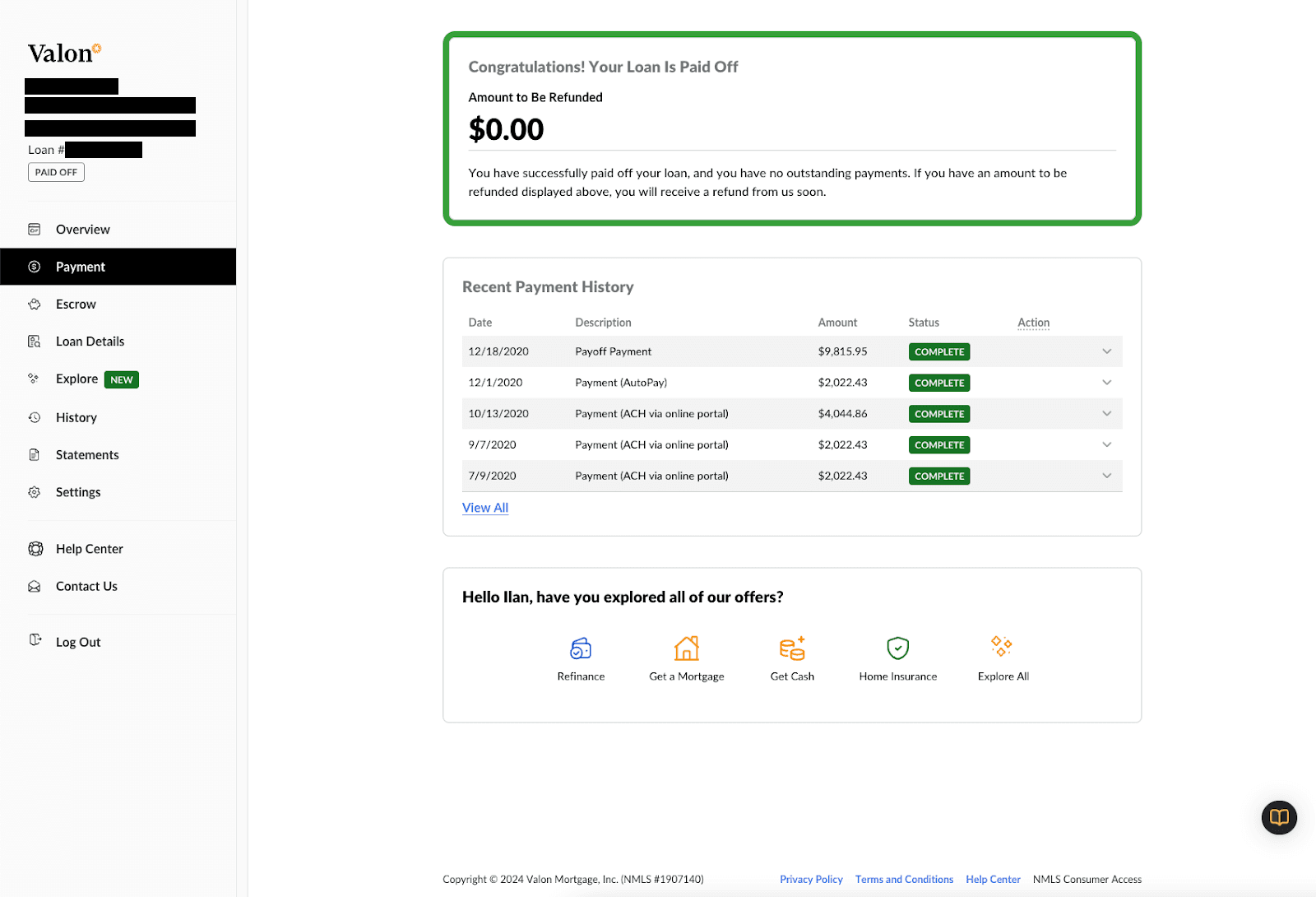

Homeowner Console

Homeowners manage their loan, make payments, view statements, and communicate with their servicer. The interface is clean, transparent, and built to reduce confusion.

Click to zoom

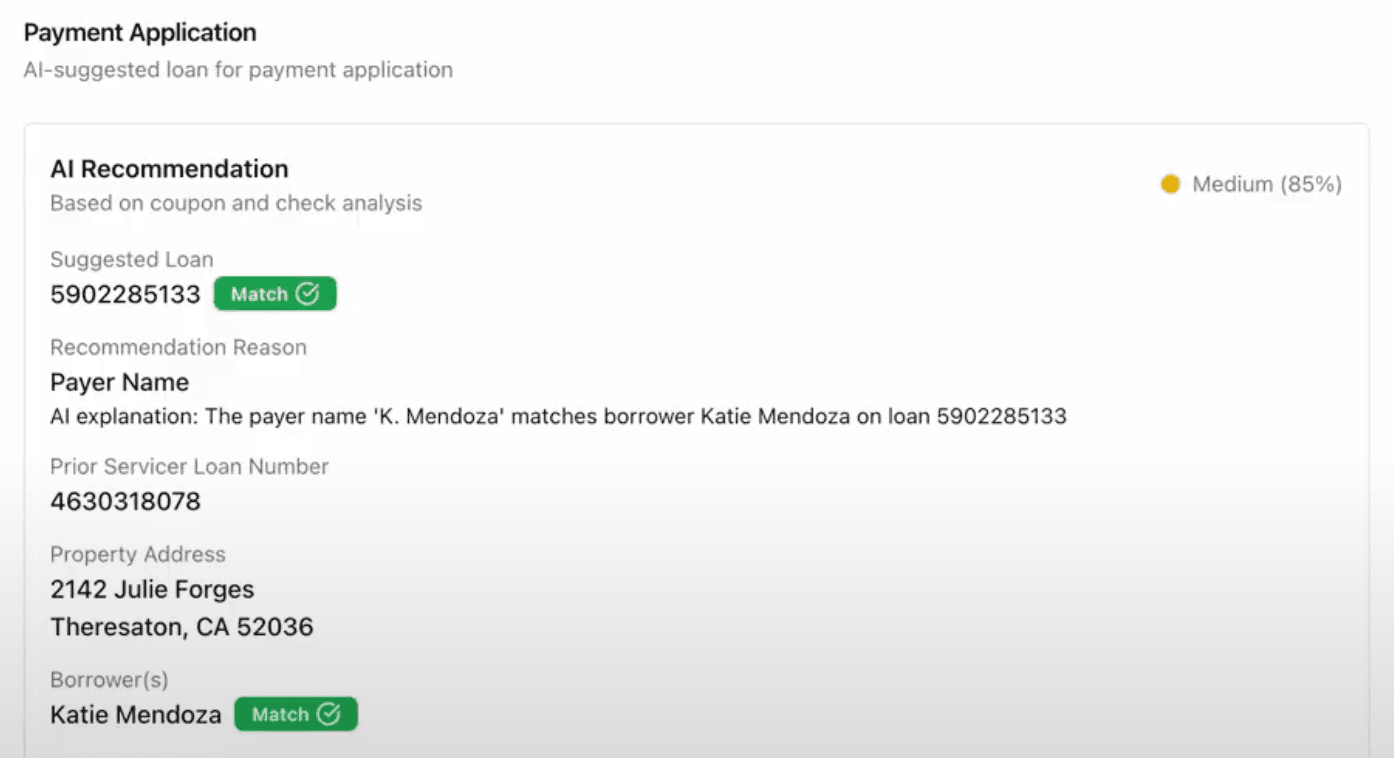

AI-Native by Design

ValonOS is being built as an AI-native operating system by design. Its unified system of record ties every process, workflow, and data source together, creating a clean and structured foundation that makes intelligence possible. By capturing consistent, high-quality data across operations, ValonOS creates the perfect flywheel for future AI capabilities.

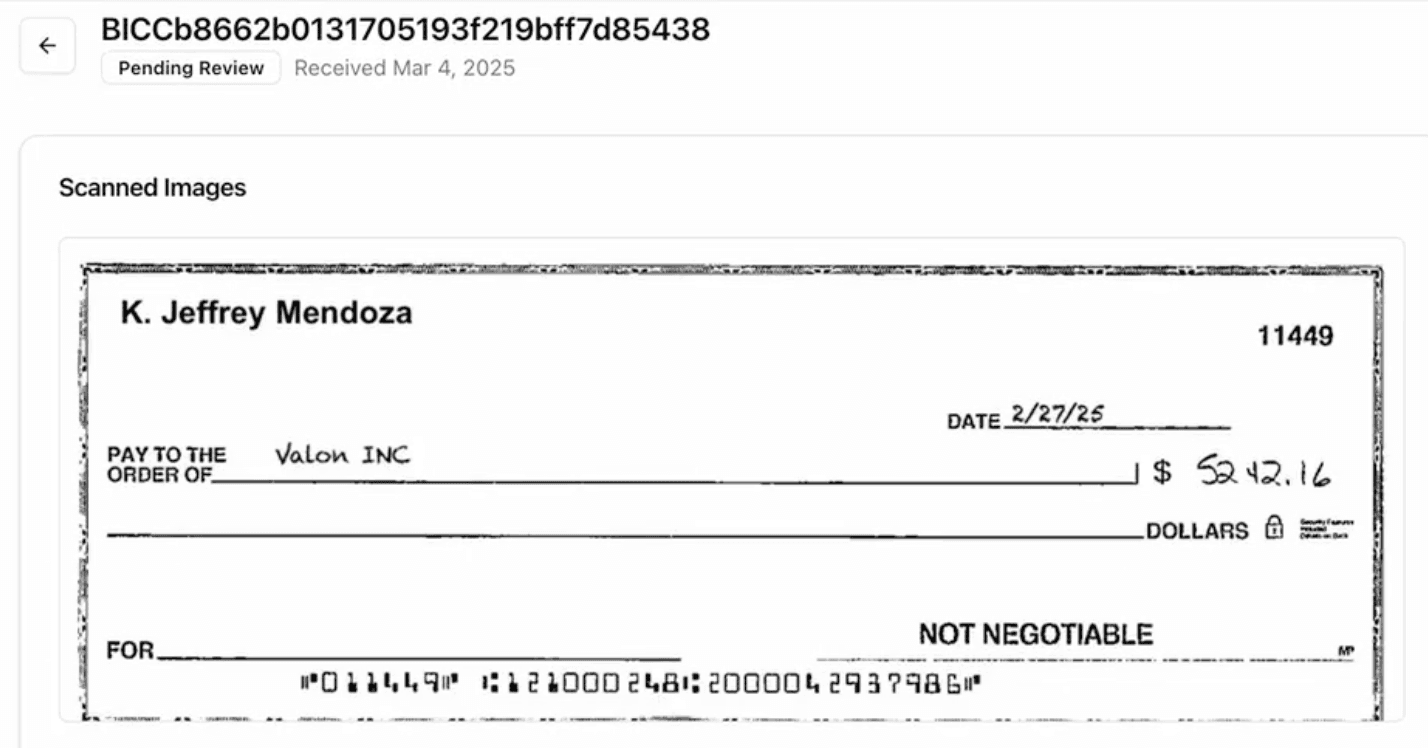

The platform is designed so that each human action, task, and workflow generates context that can later train and evaluate AI models. This architecture will enable the integration of LLMs and AI agents to automate complex operational work such as matching unidentified payments, analyzing loan histories, and improving decision accuracy.

See it in action: Here is how ValonOS is designed to handle unidentified checks using future AI assistance.

In regulated industries where reliability and auditability are essential, this approach ensures that every layer of automation is grounded in transparency and accuracy. Over time, ValonOS will learn from real operations and continually improve, turning everyday work into the foundation for intelligent, compliant automation.

Built for Scale, Designed to Endure

ValonOS is engineered for reliability in the most demanding environments. Every component is designed to handle scale without sacrificing precision, auditability, or uptime. Our architecture ensures that even as we grow, performance and stability improve over time rather than degrade.

Want to understand what it's like to build ValonOS?

Hear directly from our engineers about the technical challenges, the culture, and what it's like to work on transforming mortgage servicing from first principles.

Why I Believe AI is the Future of Mortgage Servicing

By Amy Hennig, Director of Product

Read storyWhy I Joined Valon: Designing Systems That Scale from the Ground Up

By Charles Wong, Product Manager II

Read articleWhy I Bet on Valon – and Why You Might Too

By Alex Dao, Director of Engineering

Read story